Stocks & Financial News

Breaking financial news 24/7 courtesy of TradingCharts.com Inc. / TFC Commodity Charts

(EVR) Pivots Trading Plans and Risk Controls

Warning:

The trading plans were valid at the time this was published, but the support and resistance levels for EVR change as time passes, and this should be updated in real time. Access those real time updates for this and 1000 other stocks here. Unlimited Real Time Reports

Protection from Market Crashes: Subscribers also get our Tail Risk hedge, Evitar Corte

Instructions:

Use the basic rules of Technical Analysis. Here are some examples: if EVR is testing support the signal is to buy and target resistance. On the other hand, if resistance is tested, that is a sign to short, and target support. No matter which side the trade is, long or short, the trigger point is both a place to enter and as a risk control.

Swing Trades, Day Trades, and Longer term Trading Plans:

This data can be used to define Day Trading, Swing Trading, and Long Term Investing plans for EVR too. All of these are offered here: Access our Real Time Trading Plans

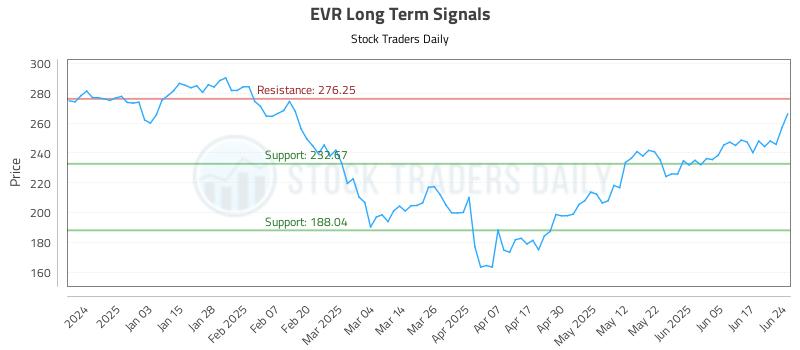

Longer Term Trading Plans for EVR

- Buy EVR near 232.67 target 276.25 stop loss @ 232

- Short EVR slightly under 276.25, target 232.67, stop loss @ 277.05

Swing Trading Plans for EVR

- Buy EVR slightly over 276.25, target n/a, Stop Loss @ 275.45

- Short EVR slightly near 276.25, target 253.66, Stop Loss @ 277.05.

Day Trading Plans for EVR

- Buy EVR slightly over 276.25, target n/a, Stop Loss @ 275.61

- Short EVR slightly near 276.25, target 254.38, Stop Loss @ 276.89.

EVR Technical Summary | Raw Data for the Trading Plans

| Term → | Near | Mid | Long |

|---|---|---|---|

| Bias | Strong | Strong | Neutral |

| P1 | 0 | 0 | 188.04 |

| P2 | 248.55 | 246.02 | 232.67 |

| P3 | 254.38 | 253.66 | 276.25 |

COMTEX_466633112/2570/2025-06-24T15:49:18