Stocks & Financial News

Breaking financial news 24/7 courtesy of TradingCharts.com Inc. / TFC Commodity Charts

Panamanians Divided Over Reopening First Quantum's Copper Mine

nationwide survey in Panama

has shed light on what locals think about the potential reopening of First Quantum's (TSX: FM) $6.5 billion Cobre PanamaÌ copper mine, which has been shut down for over a year following a Presidential decree.

The findings reveal a nation deeply divided, with people balancing concerns about environmental impacts and governance against the mine's critical economic role.

The survey, commissioned by ARCA Media en Direct and conducted by research firm DOXA, involved 1,600 face-to-face interviews nationwide and included 400 participants from communities near the mine.

The results of the survey come at a time when Panama is grappling with the economic and social ramifications of the mine's closure ordered by then-President Laurentino Cortizo after the Supreme Court ruled

the mine contract unconstitutional.

The shutdown of Cobre Panama marked a turning point for a mine that once contributed nearly 5% of Panama's GDP and accounted for 75% of its exports.

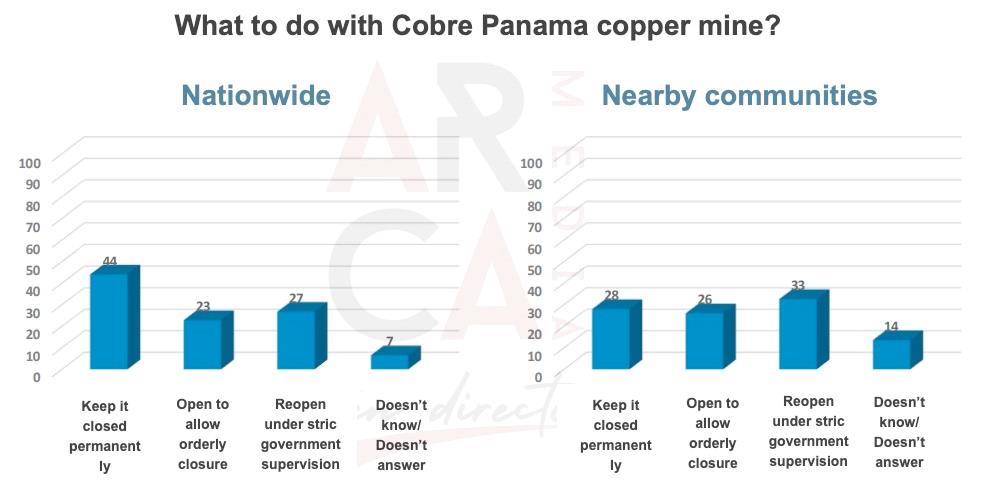

Nationally, 44% of respondents believe the mine should remain closed indefinitely; 27% of participants support reopening it under strict government supervision, while 23% advocate for reopening the mine just to enable its orderly closure.

In mining-adjacent communities, a greater proportion of respondents would support reopening the mine either to keep it operating under government supervision (33%) or to facilitate an orderly closure (26%).

Panamanians acknowledge Cobre Panama's economic significance. When survey participants opposed to reopening were presented with the potential consequences of a prolonged closure - including the loss of $4 billion annually and 40,000 jobs - 52% nationwide expressed support for reopening. However, in communities near the mine, economic arguments appear to hold less sway, with support for reopening, among those generally opposed remaining low.

When considering overall responses, people who live in surrounding areas are slightly more favorable to revisiting the contract than nationally - 65% vs 57%.

As operations at Cobre Panama remain suspended, the mine has transitioned into a preservation phase, incurring significant monthly costs. First Quantum reported spending between $11 million and $13 million per month on labor, maintenance, and environmental stability measures. By the end of October, nearly 121,000 tonnes of copper concentrate remained on-site, as First Quantum continued negotiating a permit to export the stockpiled metal.

(The main difference between a tonne and a ton is that

a tonne is a metric unit of mass, while a ton is an imperial unit of mass:

A tonne is a metric unit of mass that is equal to 1,000 kilograms or 2,204.6 pounds.

It is also known as a metric ton.)

The survey showed Panamanians are concerned about how the situation may affect the flow of foreign direct investment (FDI) if the mine remains closed. At a national level, 57% of respondents believe a continued shutdown would deter FDI, with 54% of those near the mine sharing this belief.

Respondents also expressed a strong desire for greater governmental oversight. Nationwide, 57% support reviewing the contract with First Quantum, rising to 65% among residents near the mine.

Trust in current President JoseÌ RauÌl Mulino's administration to resolve the crisis was relatively high, with 44% of respondents expressing confidence in his leadership, compared to 18% for the construction workers' union and 15% for the chamber of commerce.

President Mulino has criticized his predecessor

for leaving the issue unresolved, pledging to address it with what he calls"credibility and national acceptance."

As the government weighs its options, the survey highlights a critical tension: while a large segment of the population values the mine's economic contributions, particularly for jobs and revenue, deep-seated concerns about its social and environmental impact persist.

Any decision about the mine's future will need to address public opposition, economic imperatives, and the trust gap between communities and mining stakeholders.

MENAFN10122024000218011062ID1108977989

COMTEX_460715351/2604/2024-12-11T00:48:00